There are 3 Uniform Invoice and 2 Uniform Invoice in the unified entry form.

3 Uniform Invoice will be issued to companies, 2 Uniform Invoice will be issued to individuals or overseas companies.

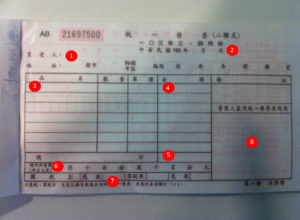

Writing 3 Uniform Invoice

1: Buyer: This is the name of the person who sold it.

2: Write a unified edition of the selling partner.

3: It is the date of sale.

4: Write the item name.

In the case of 5: 3 Uniform Invoice, write the tax exclusion amount.

6: Write the total of tax-free amount.

7: Write the operating tax amount.

8: Write the total of the business tax amount and the total amount without tax.

9: I will write the amount in Chinese text.

10: Taxable category. I usually check it into the affection.

11: I will press a special chapter of my company’s unified vote.

Calculation of business tax

Tax included amount ÷ 1.05 = Tax exclusion amount (rounded to the nearest whole number)

Tax exclusion amount X 0.05 = Tax included amount (rounded to the nearest whole number)

How to write 2 Uniform Invoice

1: Buyer: This is the name of the person who sold it. In the case of 2 Unicode it is OK.

2: It is the selling date.

3: Write the item name.

In the case of 4: 2 Uniform Invoice, write the tax included amount.

5: Write the total tax included amount.

6: We will write the amount in the Chinese sentence.

7: Taxable segment. I usually check it into the affection.

8: Press the special chapter of the unified vote of your company.

Chinese uppercase

0=零 1=壹 2= 貳 3=參 4=肆 5=伍 6=陸 7= 柒 8=捌 9=玖 10=拾